The Main Principles Of Eb5 Investment Immigration

Citizenship, with financial investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Employment Areas and Backwoods) and $1,050,000 in other places (non-TEA areas). Congress has actually approved these amounts for the following five years beginning March 15, 2022.

To receive the EB-5 Visa, Investors need to create 10 permanent U.S. tasks within 2 years from the day of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Need makes sure that financial investments add straight to the U.S. job market. This uses whether the tasks are developed directly by the company or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

7 Easy Facts About Eb5 Investment Immigration Shown

These tasks are determined through models that make use of inputs such as advancement expenses (e.g., building and construction and equipment expenditures) or annual revenues created by recurring procedures. In comparison, under the standalone, or straight, EB-5 Program, only direct, full-time W-2 employee placements within the business business may be counted. An essential danger of relying solely on straight employees is that personnel reductions as a result of market problems can cause inadequate full-time placements, possibly leading to USCIS rejection of the financier's petition if the job creation requirement is not fulfilled.

The economic model after that predicts the number of straight jobs the brand-new company is likely to develop based upon its awaited revenues. Indirect work determined via financial designs describes work produced in industries internet that supply the goods or solutions to business straight associated with the task. These jobs are developed as an outcome of the raised need for products, products, or solutions that support business's operations.

The Ultimate Guide To Eb5 Investment Immigration

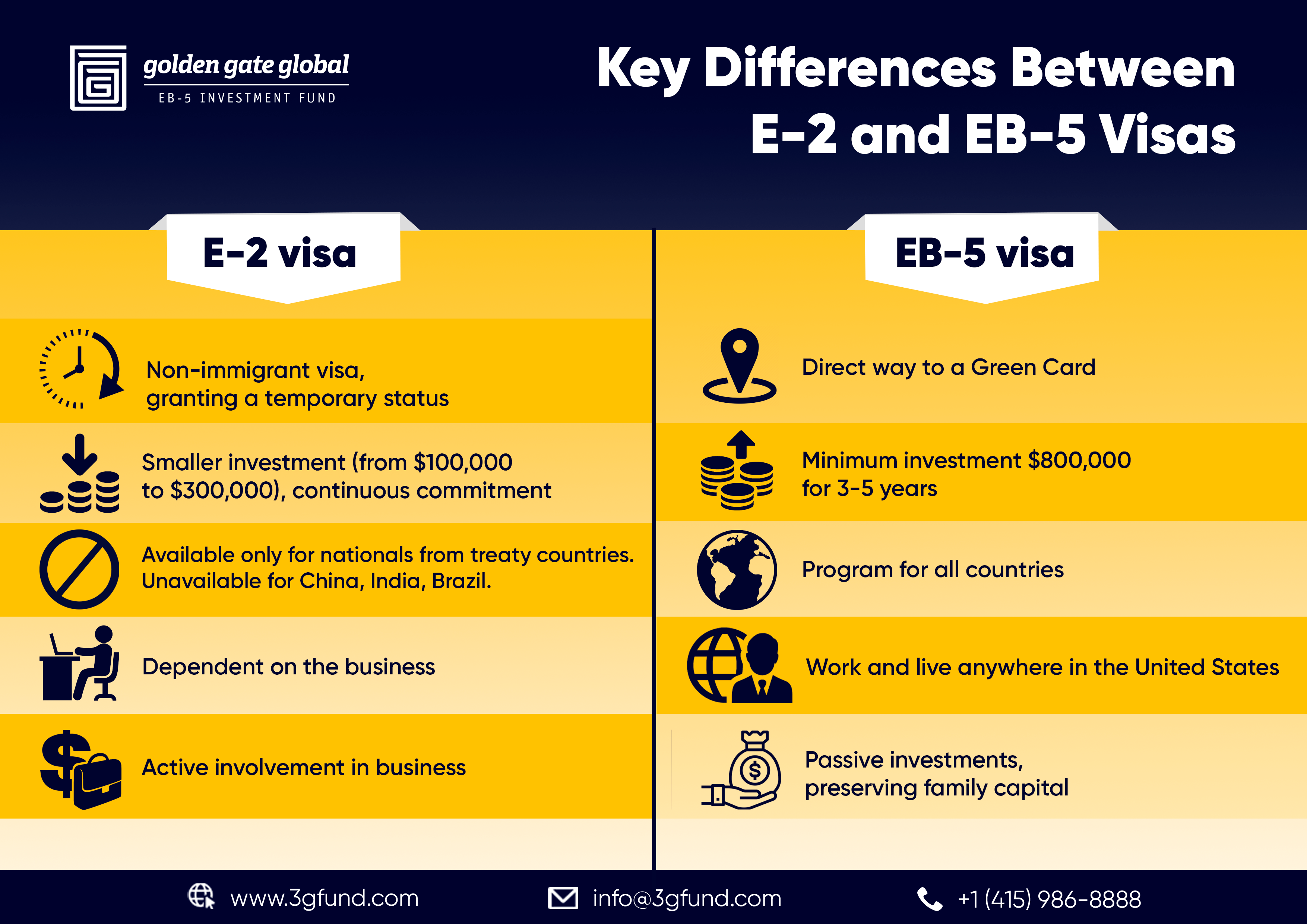

An employment-based 5th preference group (EB-5) investment visa provides an approach of coming to be a permanent U.S. resident for international nationals wishing to invest capital in the USA. In order to use for this permit, an international investor should spend $1.8 million (or $900,000 in a Regional Facility within a "Targeted Employment Area") and create or protect a minimum of 10 full time jobs for United States workers (leaving out the capitalist and their instant family members).

This step has been a significant success. Today, 95% of all EB-5 resources is increased and invested by Regional Centers. Considering that the 2008 economic crisis, accessibility to resources has actually been restricted and municipal budgets proceed to deal with substantial shortfalls. In lots of regions, EB-5 financial investments have actually loaded the funding look at this web-site space, giving a brand-new, essential source of funding for regional financial advancement tasks that revitalize neighborhoods, produce and support work, framework, and services.

Some Known Facts About Eb5 Investment Immigration.

workers. Furthermore, the Congressional Budget Plan Office (CBO) scored the program as revenue neutral, with management expenses paid for by candidate costs. EB5 Investment Immigration. Greater than 25 countries, consisting of Australia and the United Kingdom, use similar programs to attract international financial investments. The American program is extra rigid than numerous others, requiring substantial threat for financiers in terms of both their economic investment and migration status.

Households and people who seek to relocate to the United States on a long-term basis can apply for the EB-5 Immigrant Financier Program. The United States Citizenship and Migration Provider (U.S.C.I.S.) established out various demands to get permanent residency via the EB-5 visa program.: The very first action is to locate a certifying investment chance.

When the chance has actually been recognized, the capitalist should make the financial investment and send an I-526 application to the united state Citizenship and Migration Provider (USCIS). This petition must include evidence of the investment, such as bank statements, purchase agreements, and company strategies. The USCIS will certainly examine the I-526 application and either accept it or request extra evidence.

The Definitive Guide for Eb5 Investment Immigration

The financier needs to look for conditional residency by sending an I-485 request. This petition has to be sent within six months of the I-526 approval and need to consist of evidence that the financial investment was made and that it has actually developed a minimum of 10 permanent work for U.S. employees. The USCIS will certainly evaluate the I-485 request and either accept it or demand extra proof.

Comments on “Eb5 Investment Immigration Fundamentals Explained”